MANSA, PAPSS digital platforms to facilitate trade, boost economic development – Mr Gabriel Edgal

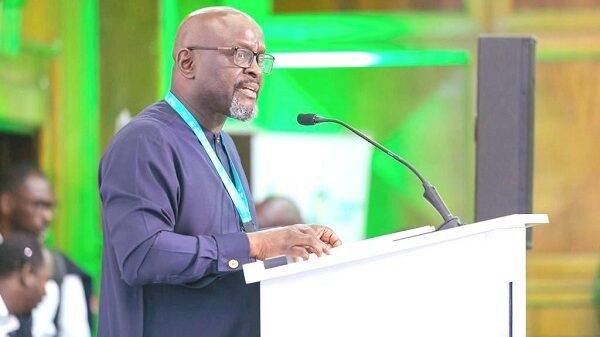

The Chairman and CEO of Oakwood Green Africa, Mr Gabriel Edgal, has emphasised the transformative impact of Afreximbank’s digital platforms, including the MANSA and Pan-Africa Payment and Settlement System (PAPSS) platforms, on Ghana’s economic development and participation in intra-African trade.

Speaking at a side event during the launch of the Africa Trade Gateway as part of Afreximbank’s Annual Meetings 2023 (AAM2023) held in Accra, Mr Edgal highlighted the significance of these platforms in unlocking Africa’s trade potential.

Mr Edgal stressed the convenience and benefits of the MANSA platform, which serves as a single source of primary data for Customer Due Diligence (CDD) and Know Your Customer (KYC) checks on African entities, including financial institutions, corporates, and SMEs.

He said by leveraging MANSA, businesses onboarded unto the platform could conveniently trade with their African customers, suppliers, and partners without the need for additional due diligence.

This streamlined process, he said, would provide a significant boost to businesses and greatly contribute to the economy by eliminating long-standing bottlenecks that have hindered intra-Africa trade.

“The MANSA Platform for instance will give a boost to businesses and help the economy significantly, as some bottlenecks that have bedeviled intra-Africa trade for so long will be eliminated with these platforms,” he said.

Mr Edgal said, “We need to start asking ourselves questions as Africans, such as; ‘How is it that trade with my neighbour just across the border has to be so painstakingly difficult?’…‘Why can I not benefit from the large markets for my products that Africa provides?’…‘Why is my focus only on international trade, imports that leave us as consuming nations instead of producing nations? It is time to think about Africa and trade among ourselves.”

On PAPSS, Mr Edgal spoke about the importance of the platform, and what it would likely mean for Ghana’s development.

“Through initiatives such as PAPSS, businesses in Ghana, for instance, can trade with their counterparts anywhere in Africa without having to convert their local currencies to dollar. If payments are being made in local currencies, it means demand for foreign currency will reduce, and once the demand for the dollar reduces, it means exchange rates will drop and the African currencies will be strengthened,” he said.

He noted, “It means importation of our inputs will now be cheaper, it means imported inflation will not be possible, as the local currencies will be more resilient due to increased demand as a result of local currency trading. Imagine the effect on our economies.”

The event witnessed the presence of key players within Ghana’s business sector and other West African countries.

BY DAVID ADADEVOH