GCB Bank recorded a profit before tax of GH¢450 million in the 2018 financial year, representing a 35.6 per cent increase of the GH¢331 million generated in 2017.

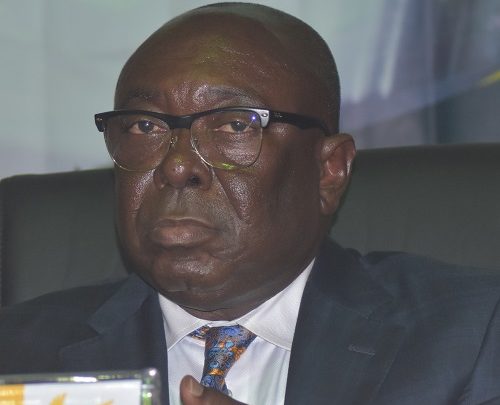

The performance, according to Jude Kofi Arthur, Board Chairman of GCB Bank, was driven by solid revenue growth which included an eight per cent increase in interest income from GH¢895 million to GH¢967 million.

Speaking at the 25th annual general meeting of the bank in Accra, he said a jump in trading income by 121 per cent to GH¢90 million from GH¢41 million and a 16 per cent increase in fees and commission income to GH¢197 million from GH¢170 million, also accounted for the impressive profit growth.

He however stated that within the year, a number of legacy issues resulted in high operational cost which was 60.5 per cent of income.

In spite of the banking challenges, he said the bank recorded a 19.6 per cent increase in deposit to GH¢8 billion from GH¢6 billion in 2017 as well as growth in assets by 11.4 per cent from GH¢9 billion to GH¢10 billion.

On the back of the growth, Mr Arthur stated that the bank had set aside GH¢79.50 million as total dividend payment which translates to GH¢0.30 pesewas per share.

A total of GH¢5.62 million was also invested in areas of health, education, environment and sanitation as part of the bank’s Corporate Social Responsibility, he added.

Backed by its transformation agenda, underpinned by digitisation, he said the bank would exploit opportunities within its strategic framework as well as those that fall within the risk-return construct to tap new market space to attract the unbanked market and consolidate its traditional banking.

As part of measures to keep Directors of the bank abreast with the new Bank of Ghana guidelines and directives, Mr Arthur said members were trained on strategy risk and reputation, corporate governance and digital transformation among others.

Managing Director of the bank, Anslem Ransford Adzete Sowah, said the bank in 2018 acquired a licence from the Securities and Exchange Commission to establish a Custody Services Department to operate as a pension and investment custodian on behalf of fund owners and investors.

The bank, he said further completed the centralisation of its back office operations and the digitisation of archival records to ensure a reduction in operation risk and cost as well as enhanced back office processing for efficient customer service.

In 2019, he stated that the bank was focused on optimising e-banking to its full potential and improving customer experience and sales generation.

Additionally, the bank introduced mortgage financing as a new product and upgraded the GCB Learning Centre to run both internal and external programmes.

BY CLAUDE NYARKO ADAMS