Ghana is to host the maiden international conference on Inclusive Insurance to come out with measures and strategies, to help close the insurance gap for the low income earners and workers in the informal sector.

The conference slated for October 23-27, is being organised by the National Insurance Commission (NIC) with partners such as the GIZ and United Nations Development Programme (UNDP), Ghana Insurers Association, Micro Insurance Network, Munich Re Foundation and the Insurance Brokers Association of Ghana.

It is expected to be attended by more than 500 delegates across the world as a platform to share ideas and knowledge on sustainable inclusive insurance.

Inclusive Insurance means the development of insurance products to suit the needs of the low income earners, the vulnerable and informal sector workers.

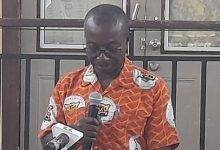

Speaking at the launch in Accra yesterday, the Acting Commissioner, Michael Kofi Andoh, said the conference would be attended by stakeholders in the insurance industry to deliberate on how technology can be deployed to promote inclusive insurance.

He said efforts to close the insurance gap had been complicated by developments such as COVID-19, and climate change, saying those events had created negative impact on the poor and low income earners.

“There is therefore now, more than ever before, the urgent need for concerted efforts byall stakeholders to find sustainable safety nets that enable the vulnerable and the bottom of the pyramid to break out poverty and live decent safe lives,” Mr Andoh stated.

He said Ghana was chosen for the conference because of the country had been at the forefront of Inclusive Insurance since 2009, and in 2011 published the country’s Micro Insurance Regulation and Mobile Insurance Regulations in 2017.

The Acting Commissioner of NIC said the conference would discuss topics such as how to help the vulnerable to protect themselves against climate change, gender sensitive insurance, digital solutions for inclusive insurance and the participants would have opportunity to meet the leading authorities on Inclusive Insurance and interact with them.

Mr Andoh appealed to corporate bodies, particularly insurance companies to support the conference to make it a success.

The Country Representative of the United Nations Development Programme, Dr Angela Lusigi, said inclusive insurance could serve as a catalyst for social and economic development, while promoting financial inclusion and safeguarding the well-being of vulnerable populations.

She said while disaster risks were on the increase, there was huge protection gap in developing countries, where less than five per cent of disaster losses were covered by insurance, versus 50 per cent in high-income countries.

“We have every confidence that his strategic conference will enable experts across the globe to come up with a whole society approach and foster partnerships and resources required to reduce vulnerabilities through the use of inclusive insurance mechanisms,” Dr Lusigi, adding that the conference would help Ghana to learn from the successes and failures inclusive insurance market space from other countries.

The representatives of GIA, Munich Re Foundation and IBAG in their remarks commended NIC for the efforts to win the bid to host the programme in Ghana.

BY KINGSLEY ASARE