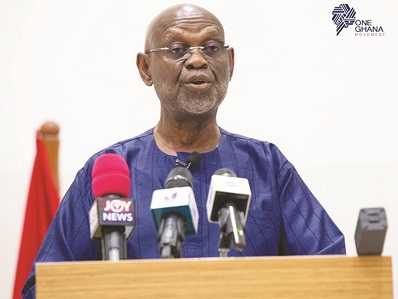

Professor Kwesi Botchwey, Ghana’s longest serving Finance Minister, has proposed wide-ranging measures to address the economic challenges confronting the country.

He said the current macro-economic indicators, including the country’s debt to GDP ratio, inflation rate, and drop in credit worthiness rankings, fast depreciation of the cedi against the US dollar, rising cost of fuel among other indicators pointed to the fact that the nation was in economic crisis.

“The crisis is here and if it is not resolved, it will lead to a catastrophe,” Prof.Botchwey, who served as Finance Secretary in the military led Provisional National Defence Council (PNDC) era as well as the Finance Minister during the National Democratic Congress civilian rule, all under the late Jerry John Rawlings, said when he delivered a lecture on the economy at Legon in Accra on Monday.

The lecture was organised by the Department of Economics, University of Ghana, in collaboration with the One Ghana Movement, a civil society organisation, in commemoration of Ghana’s 65th Independence anniversary.

It was on the topic: “On the state of the nation’ economy and politics; 65 years after independence, the path to sustainable development and democratic consolidation.”

Prof.Botchwey said the government must first recognise the severity of the economic crisis to ensure the smooth implementation of swift economic reforms.

He said such reforms, which would be intended to put the economy back on track, would require both the government and the people to make some sacrifices in the interest of the nation.

“There is no silver bullet or magic solution somewhere that will bring lasting relief without some level of pain. The real question is how we distribute this hardship in an equitable and transparent manner,” he said.

Prof.Botchwey said the government must review its flagship policies, with key focus on sustainability and impact to help cut government expenditure in the wake of the current crisis.

“The problem is much about raising more revenue as it is about streamlining our public expenditure. We must not for instance transition temporary spending incurred during the pandemic into permanent public spending,” he said.

Prof.Botchwey further urged the government to desist from collateralising public revenue schemes among other policies that would further “mortgage the future of the young generation.”

He said the government must within this period desist from issuing bonds that would mature before 2025, cautioning that doing so would plunge the country into unsustainable debt levels.

“For example, whoever’s takes the reins of government in 2025 will have to shed a whopping $1.5 billion in Eurobond principal payments within months of assuming office.

“If we don’t rebuild the Sinking Fund and we are unable to access international capital markets to refinance our Eurobonds, then this could mean that the next government may default in its maturing Eurobond obligations in 2025,” he said.

Prof.Botchwey said the country needs to build consensus and create the political space around the reforms necessary to restore the nation’s credit worthiness. He said measures to address the country’s current economic challenges should not be hinged on assistance from the International Momentary Fund (IMF).

He said the country must rather own its economic policies by deploying homegrown strategies to resolve the problem. – GNA