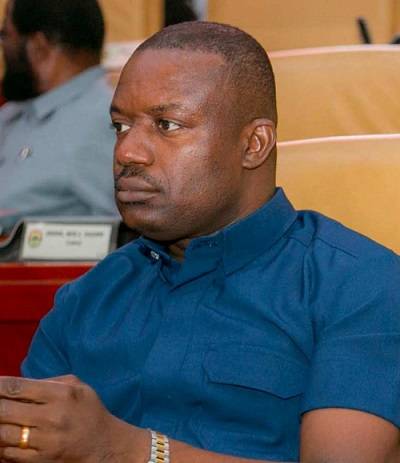

Member of Parliament (MP) for the Yapei/ Kusawgu Constituency, John Abdulai Jinapor, has called on the legislature to take interest in developments at the Bank of Ghana (BoG) and investigate the losses it has incurred in 2022.

He said: “Mr Speaker, the equity of the BoG is negative GH¢55 billion. We have never witnessed this and I think that as a Parliament, we should take interest in investigating how come the central bank makes a loss of GH¢55 billion in terms of equity in one year.

Mr Jinapor was commenting on the Mid-Year Review of the Budget Statement and Economic Policy of the Government presented to Parliament by the Finance Minister, Ken Ofori-Atta in Accra, on Monday.

He said, “When we were leaving office in January 2017, the Bank of Ghana made GH¢709 million profit. We had a positive equity of GH¢4 billion.”

According to Mr Jinapor, the only way the Bank could pay for the loss is to print money “and when you print money, it spikes inflation.

“It is, therefore, not surprising that Ghana’s inflation hovers around 43 per cent. It is complete mismanagement of the economy,” he stated and urged Parliament to take interest in the matter.

Governor of the bank, Dr Ernest Addison, in the foreword of the 2022 Annual Report and Financial Statements of the bank, said the central bank incurred a loss of GH¢60.8 billion as a result of the restructuring of the bank’s holdings of government debt and forex exchange losses.

He said, “The negative equity position was not the result of sub-optimal policy decisions but emanated from the restructuring of gov¬ernment debt and adverse market movements. This negative equity does not imply loss of policy effectiveness, and is expected to correct as the economy recovers and foreign reserves build up.”

Meanwhile Bolgatanga Central MP, Isaac Adongo, said the ramifications of the loss would have rippling effect on the economy of the country and individuals for many years to come.

But, a Deputy Minister of Finance, Abena Osei-Asare, said the central bank has been up to task until last year when global economic conditions pushed it beyond its limits.

The deputy minister, who is also Atiwa East MP, said variables that accounted for the GH¢60 billion loss; included the GH¢55 billion loss in the domestic debt exchange programme.

“The BoG took a 50 per cent haircut on the principal and that alone amounted to GH¢33.2 billion. Beyond the 50 per cent haircut, there was also a marketable instrument of GH¢16.1 billion that the BoG had to take a hit on. With the adjustment of the cocoa bonds, there was also a loss of GH¢4.7 billion.

“The BoG also had a loss in interest expenses to the tune of GH¢3.3 billion and exchange rate valuation of GH¢5.2 billion,” she said.

Mrs Osei-Asare said, “This is not the first time a central bank across the world would record losses,” and cited examples from Czech Republic in 2002, Germany in early 1970s, Australia and the UK and Switzerland, all in 2022

BY JULIUS YAO PETETSI