The government has revised the country’s overall fiscal deficit target in 2022 to 6.6 per cent of Gross Domestic Product (GDP), from the earlier 7.4 per cent.

This is due to cuts in expenditure and expected improvement in revenue for the rest of the year.

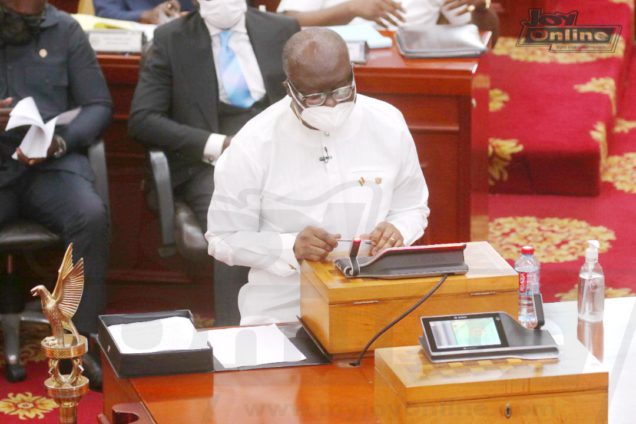

Presenting the Mid-year budget review to Parliament on Monday, Mr Ken Ofori-Atta, Minister of Finance said, the government had also revised the primary surplus target to 0.4per cent of GDP, up from a surplus of 0.1 per cent of GDP.

The government in March 2022 announced the implementation of the 30 per cent discretionary expenditure cuts and other expenditure measures.

Some expenditure measures were the moratorium on foreign travels except pre-approved critical and/or statutory travels, 50 per cent cut in fuel coupon allocations for all political appointees and heads of government institutions, including State Owned Enterprises, effective April 1st, 2022.

The government also recently approved 15 per cent Cost of Living Allowance (COLA) to all public servants.

Accordingly, total revenue and grants have now been revised to ¢96.84 billion (16.4 per cent of GDP) in 2022, from the 2022 Budget target of ¢100.51 billion (20.0 per cent of GDP). This represented 3.7 per cent reduction.

Total Expenditure including payments for the clearance of arrears has also been revised downward to ¢135.74 billion (22.9 per cent of GDP), from the original budget projection of ¢137.52 billion (27.4 per cent of GDP).

Interest Payments have however been revised upwards from ¢37.44 billion (7.5 per cent of GDP) to ¢41.36 billion (7.0 per cent of revised GDP). This is mainly on account of inflationary pressures and exchange rate depreciation resulting in a higher cost of financing.

The revisions in government’s fiscal operations results in a fiscal deficit (on cash basis) of ¢38.900 billion (6.6 per cent of revised GDP), up from the 2022 Budget deficit target of ¢37.012 billion (7.4 per cent of GDP).

Mr Ofori-Atta said although the deficit was expected to be financed from both foreign and domestic sources, domestic financing would be the key driver while the government works to regain external market access.