Ghana’s sovereign dollar bonds dropped sharply on Tuesday after a government presentation of debt rework scenarios that aimed for a haircut of 30 per cent to 40 per cent on the principal disappointed investors.

Some bonds fell to their lowest level in three months, with the 2061 issue down as much as 2.9 cents on the dollar to 38.9 cents, Tradeweb data showed.

The bonds later recovered some ground, though were still down between 1.5 cents and 2.5 cents on the dollar.

Ghana is in talks with bilateral and commercial creditors to restructure its debts during its worst economic crisis in a generation, having been locked out of international capital markets as it struggles with spiralling domestic debt costs.

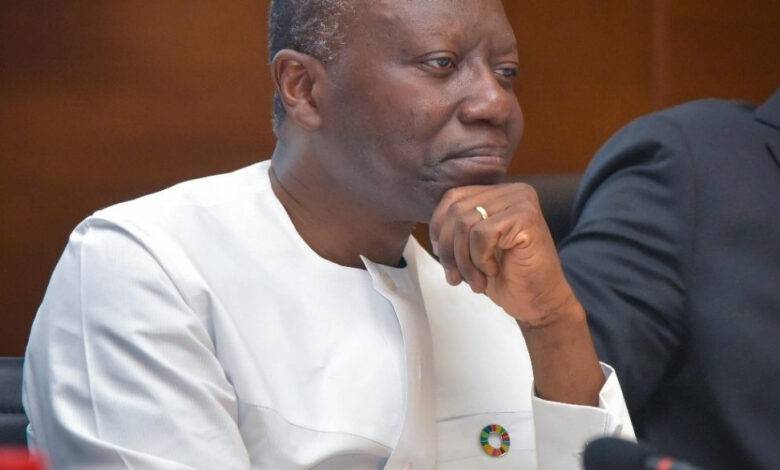

Apart from the haircut, Finance Minister, Ken Ofori-Atta, also told investors the government was aiming for a coupon of no more than 5 per cent and a final maturity of not more than 20 years on bonds that would be issued as part of the rework for its $13 billion of outstanding international notes.

While exact details were still missing, Morgan Stanley said in a note to clients it had calculated a recovery value of $38 versus the current average price of $44 on the bonds.

“In our view, this proposal is unlikely to be accepted by the bondholders as the ultimate recovery value would be extremely low compared to history,” Morgan Stanley’s Neville Z Mandimika said.

“However, it is important to note that this is only a first proposal and various revisions will likely be made, presumably with a higher recovery value,” Mandimika added.

Stuart Culverhouse at Tellimer estimated a recovery value of $31.5-$44 if past due interest is included following the presentation – a lower outcome than he had previously expected.

“We still think 30-40 per cent haircuts – and Greece-like 60-70 per cent haircuts in PV (present value) terms – sounds excessive and unjustified,” Culverhouse wrote in a note, calling Accra’s hopes for an agreement in principle by year-end “ambitious”.

A possible inclusion of so-called value recovery instruments (VRIs) – structures that link payouts to variables such as GDP growth – in the debt rework could improve the outcome for bondholders, analysts said.

Barclays calculated that including past due interest as well as a recovery instrument could lead to a recovery value of $50.

Others said write-offs needed to be meaningful to make a difference to the restructuring countries.

Ghana, together with Zambia and Ethiopia, is reworking its debt under the G20 Common Framework programme – an overhaul mechanism launched in late 2020 for poor nations buckling under debt burdens, but which has been widely criticised for slow progress.

“Ghana’s proposal is the first economically sustainable proposal put forth at the G20 Common Framework,” Kevin Gallagher, director of Boston University’s Global Development Policy Centre, said.

“If Ghana gets upward of 40 per cent haircut and invests in their Climate Prosperity Plan they can harness a real recovery,” he said. -Reuters