Traders ditched riskier assets on Monday as relief over Emmanuel Macron’s victory in the French presidential election quickly gave way to renewed concerns about the impact of rising interest rates on global economic growth.

Asian markets suffered their worst session in over a month as worries that Beijing could soon be back in lockdown sent Chinese shares back to 2020 lows, and as the effects of Wall Street’s 2.5 per cent slump on Friday lingered. .

The bashing continued in Europe. The STOXX 600 index (.STOXX) dropped to its lowest since mid-March, weighed by two per cent and 1.9 per cent drops in French (.FCHI) and German (.GDAXI) shares, respectively. The euro slid 0.75 per cent to its lowest since the initial COVID-19 panic of March 2020.

“The reality is there is more to the French election story than Macron’s win yesterday,” said Rabobank FX strategist Jane Foley.

Not only are there parliamentary elections still to come in France in June, but Macron also seems likely to keep the pressure up for a Europe-wide ban on Russian oil and gas imports, which would cause serious economic pain, at least in the short term.

“We had German officials saying last week that if there was an immediate embargo of Russian energy then it would cause a recession in Germany. And if there was a recession in Germany, that would drag the rest of Europe down and have knock-on effects for the rest of the world,” Foley said.

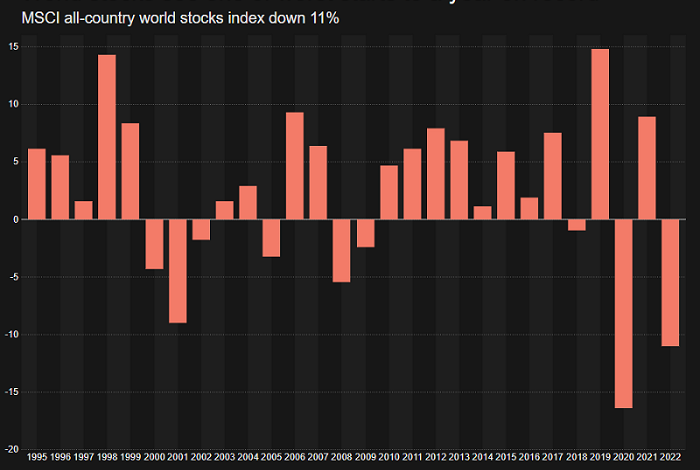

MSCI’s broadest index of world shares (.MIWD00000PUS) slid 0.8 per cent to a six-week low. Oil fell over four per cent and worries about Beijing saw the Chinese yuan skid to a one-year low.

State television in China reported that residents were ordered not to leave Beijing’s Chaoyang district on Monday after a few dozen COVID cases were detected over the weekend.

The China-sensitive Australian dollar fell as much as 1.2 per cent while the U.S. dollar climbed unhindered to a two-year high, hitting $1.0707 against the euro and 1.2750 versus Britain’s pound.

Much focus on is on how fast and far the Federal Reserve will raise U.S. interest rates this year and whether that will help tip the world economy into recession.

This week is also a packed one for corporate earnings. Almost 180 S&P 500 index firms are due to report. Big U.S. tech will be the highlight, with Microsoft and Google both on Tuesday, Facebook on Wednesday and Apple and Amazon on Thursday.

In Europe, 134 of the Stoxx 600 will also put out results, including banks HSBC, UBS and Santander on Tuesday, Credit Suisse on Wednesday, Barclays on Thursday and NatWest and Spain’s BBVA on Friday.

U.S. futures were pointing to more falls after Friday saw the Dow Jones (.DJI) suffer its worst day since October 2020 and the as CBOE volatility index (.VIX), dubbed Wall Street’s “fear gauge,” continue to drive higher.

Monday’s selloff in Asia also saw Hong Kong’s Hang Seng (.HSI) fall 3.7 per cent and the Shanghai composite index (SSEC) slide over five per cent. – Reuters