Parliament has put on hold the debate on whether or not to approve a US$23,983,033 tax waiver for Platinum Properties Limited (PPL) for the Pullman Accra Airport City Hotel and Serviced Apartments.

The project is being promoted by PPL as a Special Purpose Vehicle owned and controlled by Inter-Afrique Holdings Limited and the Ghana Infrastructure Investment Fund.

The House is being asked to grant the tax waiver for import duties for the procurement of materials, plant, machinery and equipment for the project in line with Article 174(2) of the 1992 Constitution.

“Where an Act, enacted in accordance with clause (1) of this article, confers power on any person or authority to waive or vary a tax imposed by that Act, the exercise of the power of waiver or variation, in favour of any person or authority, shall be subjected to the prior approval of Parliament by resolution,” the Constitutional provision reads.

The project scope include 215-keys business hotel and presidential suite restaurants, two bars, two smiling pools, gym and spa, 11 meeting rooms, and one multipurpose hall, among other features.

The Finance Committee’s report on the request recommended its approval stating that the project is “positioned to become Ghana’s largest and most distinguished hotel facility.”

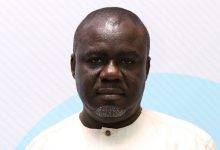

Moving the motion for the approval, Chairman of the Finance Committee, Dr Mark Assibey-Yeboah, said the project, to be sited at the Airport City development enclave, would “augment the aviation industry and help attract more high profile business meetings and social visitors into Ghanaian capital.”

According to Dr Assibey-Yeboah, MP, New Juaben South, the implementation of the project (phase 1) is expected to generate substantial amount of taxes for government over the initial period of operation.

“It is estimated that annual revenues for Pullman Accra Airport City will be in excess of US$550 million over the first ten years of operation. The government will make an estimated Value Added Tax (VAT) of US$90 million and US$26 million in corporate taxes over this period,” he said.

Seconding the motion, Information Minister and Member for Ofoase/Ayirebi, Kojo Oppong Nkrumah dismissed earlier claims by the Minority that the waiver was being given because President Akufo-Addo has interest in the investment.

“If the President had suo moto given approval of this waiver, as we are being told, there would be no need coming to this House seeking parliamentary approval,” he said.

In his view, that argument is unfounded and that the request was well within the provisions of Section 26(4) of the Ghana Investment Promotion Centre Act which allows for waivers to be granted in consultation with other institutions.

He accused the Minority of insincerity because they, in the past, granted waivers to companies like Ghacem, Dream Realty, Garden City Mall, Shoprite Ghana, Dzata Cement, among others, without due process.

But in a sharp rebuttal, Yapei/Kusawgu Member, John Jinapor, said there was no demonstration that the hotel would be profitable.

“Mr Speaker, nothing before the Committee or here on the floor shows that this hotel will be profitable. We asked for it but it has not been given,” he stated adding that the comparison with other waivers granted in the past was a mismatch because some got strategic investment status.

The debate, however, was suspended by Speaker Aaron Mike Oquaye to make way for a Committee of the Whole meeting, which has been rescheduled on several occasions and underway at the time of filing this report.

BY JULIUS YAO PETETSI