Insurance experts from 36 developing countries have converge in Accra to discuss measures to boost insurance industries in developing economies.

The objective of the four-day international conference aimed at coming out with measures to increase the share of developing economies in the global insurance market.

It is being hosted by the National Insurance Commission (NIC) and Organised by the Association of Insurers and Reinsurance of Developing Countries (AIRDC).

It has the theme; “Building Resilience in the Heat of a Global Economic Tussle.” The programme is being held under the auspices of the Association of Insurance Supervisory Authorities for Developing Countries.

The participants who are chief executive officers, experts, practitioners from insurance and reinsurance companies are from Ghana, Egypt, Nigeria, Angola, Togo, Benin, Kenya, Guinea, Liberia, Nepal, Philippines and Senegal, among others.

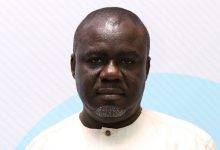

The Commissioner of Insurance, Dr Justice Yaw Ofori, said Ghana was hosting the 22nd AIRDC educational international conference for the first time.

He said the last time the conference was held in West Africa was 20 years ago (2002) in Nigeria.

Dr Ofori said the objective of the programme was to come out with strategies to increase the share of the developing economies of the global insurance market.

According to him, the share of the developing countries in the global insurance market was paltry and a huge chunk of insurance businesses were operated by developed economies.

Dr Ofori said the conference would help the insurance and reinsurance companies to come together, collaborate and have a united front and voice in the world insurance market.

The Commissioner of Insurance said the conference would create avenues for the insurance and reinsurance companies to discuss technological innovations to enhance the insurance industry.

The President of AIRDC, Yassir Albaharna said the theme for the conference was chosen in view of global economic developments.

“The subject of resilience has gained a lot attention lately, as world economies continue to be impacted by range of macro-economic, political, social and technological factors on a scale not before.

Building greater resilience has therefore become a defining mandate of our time,” he said.

Achieving financial resilience, Mr Albaharna, said depended on the development of financial strategies that relied on country risk assessment and financing tools.

Dr Mohamed Ibn Chambas, a former Special Representative of the Secretary-General and Head of the United Nations Office for West Africa and Sahel, who was the Special Guest of Honour said insurance as a risk transfer mechanism, had played fundamental roles in helping humanity overcome adversities.

Particularly, in Ghana, he mentioned the 2001 Accra Stadium Disaster in which more than 100 people died and the June 3, 2015 twin disaster which killed more than 150.

Dr Chambas expressed the hope that the insurance industry in developing world could help address the currently global economic challenges, saying “I am optimistic that insurance can once again play the critical role it has frequently demonstrated in difficult periods.”

BY KINGSLEY ASARE