Ghana, will by June this year, be delisted from the countries with high levels of deficiencies in Anti-Money Laundering (AML) and Counter Terrorist Financing (CTF) regimes, the European Commission (EC), has announced.

This decision by the Commission to remove the country from such list follows the acknowledgement of the strides that Ghana has made in implementing the action plan of the International Country Risk Guide (ICRG) in record time.

At a meeting between President Akufo-Addo and the President of the European Council, Charles Michel, the European Union lauded the country for its reforms and sustainable actions, leading to its delisting.

“The Commission, thus, congratulated Ghana for the reforms embarked on, as well as the sustainable, robust systems deployed towards being taken of the list,” a statement signed and issued by the Director of Communications at the Office of the President last Friday said.

“It is expected that the Financial Action Task Force (FATF), the global money laundering and terrorist financing watchdog, would, in June 2021, announce that Ghana has been taken off its list of high risk, third-world countries with strategic deficiencies in Anti-Money Laundering and Countering of Terrorism Financing,” the statement had it.

Ghana was, added to more than 20 countries, including some African neighbours, Nigeria, Botswana, Mauritius and Zimbabwe, as countries with strategic deficiencies in their anti-money laundering and counter-terrorist financing frameworks by the Commission.

Other countries that were included in the list were Bahamas, Barbados, Jamaica, Nicaragua, Panama, Cambodia, Mongolia, Syria, Trinidad and Tobago and Myanmar.

The inclusion of Ghana in the blacklist meant that financial transactions from the country into EU and vice versa received extra scrutiny to ensure that they did not escape the “deficiencies” identified to the benefit of money launderers and terrorist financiers.

Although the listing did not entail any type of sanctions, restrictions on trade relations or impediment to development aid, it required banks and obliged entities to apply enhanced vigilance measures on transactions involving those countries.

For each country, the Commission assessed the level of existing threat, the legal framework and controls put in place to prevent money laundering and terrorist financing risks and their effective implementation.

Executive Vice-President of the Commission, Valdis Dombrovskis, in the press release to that effect said, “We need to put an end to dirty money infiltrating our financial system. Today we are further bolstering our defences to fight money laundering and terrorist financing, with a comprehensive and far-reaching Action Plan.”

“There should be no weak links in our rules and their implementation. We are committed to delivering on all these actions – swiftly and consistently – over the next 12 months. We are also strengthening the EU’s global role in terms of shaping international standards on fighting money laundering and terrorism financing,” it added.

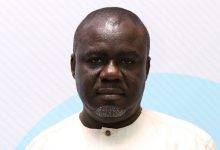

Picture: Mr Ken Ofori-Atta, Minister of Finance

BoG reviews corporate governance and risk management guidelines for RCBs

The Bank of Ghana has reviewed its corporate governance and risk management guidelines for Rural and Community Banks (RCBs).

This is coming after the cleanup of the financial sector that ended in 2019.

The review by the Bank of Ghana is to ensure a safe, sound and healthy RCBs that is central to financial intermediation in the rural and community areas.

The objectives of the corporate governance directive according to the BoG was to compel RCBs to adopt sound corporate governance principles and best practices to enable them to undertake their licensed business in a sustainable manner, as well as protect the interest of depositors, among others.

The directive will also ensure that the strategy and objectives of RCBs are set, whilst their risk appetite and day-to-day business operations are well structured.

One critical point in the directive is the intervention of the Bank of Ghana in appointments. In this regard, the proposed director elected at the Annual General Meeting or appointed at a Board Meeting shall not take up the office of Director on the Board unless a prior written approval has been granted by the Bank of Ghana.

Also, an RCB shall notify the Bank of Ghana of the changes in its directors and key management personnel as soon as the changes occur and obtain prior written approval from the Bank of Ghana before assumption of duty.

Shareholding in RCBs shall be restricted to only Ghanaians.

The shareholding limits shall apply to a shareholding by any natural person and shall not exceed 30 per cent of total shares.

Family or related party ownership shall also not exceed 40 per cent of total shares, whilst community participation in ownership shall not be less than 20 per cent of total shares.

The Bank of Ghana may review the shareholding limits from time to time or as and when it deems fit.

The Board shall operate under a Board Charter which outlines the appropriate governance practices for its own work and have in place the means to ensure such practices are followed and periodically reviewed for improvement.

The Board Charter shall define the authority of the Board and set out the following minimum standards including overall board responsibility, code of ethics for directors and the structure of the board which clearly articulate its composition and functional arrangements.

For the risk management guidelines, it has been designed to provide a framework within which regulated rural banks will establish and embed a culture of risk management in their respective institutions.

It will also ensure, among other things that Rural and Community Banks have a structured approach to risk management that meets the minimum standards expected of them. This will help minimise credit exposure and operational risk.

The guidelines set out the minimum standard provisions on policies and procedures that would have to be covered in the various policies and procedures manuals used by the RCBs.

The guidelines will also provide RCBs with the needed guidance to protect their institutions from losses, protect and attract capital, instil confidence in the regulator and other stakeholders through the adoption of measures that promote stability in rural banks and the wider financial sector.

Picture: Bank of Ghana