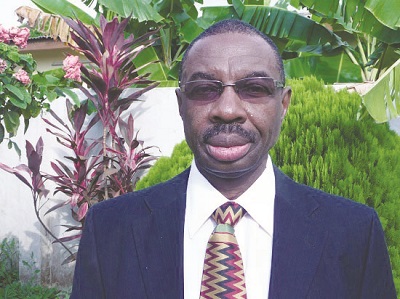

A former Technical Advisor at the Finance Ministry, Dr Sam Mensah has called for some drastic expenditure cuts and prudent use of public expenditure to deal with Ghana’s rising public debt stock.

Speaking on PM Express Business Edition on JoyNews, Dr Mensah noted that another way of dealing with the situation was the political will to take on public officials that have misappropriated state funds.

Dr Mensah made these comments on the topic; Ghana’s Rising Debt Stock and the Financial Sector.

Ghana debt stock has reached GH¢291 billion ending December 2020. There are fears that looking at the way the country’s debt stock is rising, it could soon be classified as a Debt Distress country when the World Bank meets this year to review the debt distress positions of its members for this year.

There have been proposals for Ghana to completely halt borrowings to check this.

But speaking on PM Express, Dr Mensah noted that it might be difficult to do that.

“How do you deal with the bonds that are maturing and other commitments that are due when you halt borrowing? For now we can look at how to drastically slow the rate of growth, which I understand some measures are already been taken,” he said.

He maintained that the situation could be controlled by ensuring that borrowing funds were advanced to investment sectors, rather than consumption.

Asked whether revenue mobilisation is the solution to rising debt stock, Dr Mensah noted that revenue mobilisation plays a significant role in dealing with the debt issue.

“I believe that if we improve revenue significantly that could help with Ghana’s debt situation,” Dr Mensah said.

He also noted that during his engagement with all the ministers, it was clear that they were worried about rising debt stocks and what should be done to control the situation, however, the political pressures made it difficult to some extent.

Some industry watchers have argued that Ghana rushed into the international capital market for borrowings after it achieved the middle income status.

Ghana in 2007 issued about $750 million, the first in the sub-region to do so. But Dr Sam Mensah rejected this, arguing that it was needed because most of Ghana’s development partners were not willing to lend to us because of our status.

Dr Mensah noted that the amount of money that the government was able to secure from the donor partners were dwindling, a development that forced government to look elsewhere.

“For instance, it took about two to three years to finalise a bilateral loan, while the Eurobond can be secured within a month or two,” the former technical advisor noted.

He however, rejected the argument that, Ghana rushed to borrow from the capital market.