Development Bank Ghana shows commitment to operating sustainable business … signed on to United Nations Global Compact

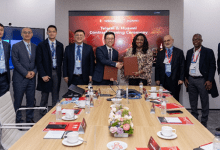

The Development Bank Ghana (DBG) has signed on to the United Nations Global Compact as part of the bank’s effort to strengthen its commitment and operations with a sustainable business and greater governance framework.

The United Nations Global Compact is a United Nations pact which enjoins its signatories, mostly businesses and firms worldwide, to adopt sustainable and socially responsible policies, and to report on their implementation.

The compact has ten principles on human rights, labour, environment and anti-corruption.

Speaking at a signing ceremony with the UN Global Compact Network – Ghana, the Chief Executive Officer of DBG, Kwamina Duker, said the signing of the pact was to reinforce the bank’s commitment to uphold and protect human rights, labour and anti-corruption principles through its business practices.

He said the compact provided DBG with a universal language for corporate responsibility and framework to guide all businesses regardless of size, complexity or location.

Mr Duker stressed that DBG supported public accountability and transparency and was committed to reporting on the progress of the UN Global Compact, in its annual Communication on Progress as demanded of the signatories of the compact.

“DBG is pleased to join the many organisations all over the world who are signatories to the UN Global Compact and who believe as we do, that ethical business conduct is an important component that enables companies to foster sustainable development,” he said.

Mr Duker indicated that the tenets of the UN Global Compact were strategies DBG currently employed in its business operations.

“The UN Global Compact also positions DBG to effectively assess, define, implement, measure and communicate the bank’s sustainability strategy goals,” Mr Duker stated.

He said the key pillars of DBG’s mission were to foster strong partnerships to finance economic growth, create jobs and build the capacity of Small and Medium-sized Enterprises (SMEs) towards achieving sustainable growth.

“So, in joining the UN Global Compact, DBG looks to strengthen its ability to serve as a catalyst for responsible business practices,” Mr Duker, stressed.

He e said five per cent of the bank’s portfolio had been earmarked for Environmental Sustainable Governance programmes to build the capacity of SMEs on sustainable business practices.

Mr Duker said all the partner participating institutions, supplies and clients were enjoined to uphold the UN Global Compact.

Deputy CEO of DBG, Michael Mensah-Baah, said the signing was the bank’s long-term commitment to sustainable business practices.

He said the bank would adhere to the tenets of the compact in its quest to provide long-term finance for SMEs, adding the compact would not be a nine-day wonder, but become part and parcel of the operations of the bank.

The Executive Director of the UN Global Compact Network – Ghana, Tolu Kweku Delacroix, said it was important for businesses to uphold sustainable business practices in their operations and lauded DBG for singing to the compact.

Mr Delacroix said DBG was the first financial institution in the country to sign onto the UN Global Compact.

He indicated that the signing of the compact would help boost the image of DBG to attract more funding.

According to him, companies that had signed onto the compact had been able to increase their profit margins by 13 per cent.

He said the UN Global Compact was the world’s largest corporate sustainability initiative with 13,000 corporate participants with the objective to mainstream the ten business sustainability principles in business activities all over the world.

DBG is Ghana’s new development institution established in 2017 to, among others, facilitate and strengthen and provide long-term credit for SMEs to drive their economic growth and transformation.

The bank has received funding from the World Bank, European Investment Bank, KfW and the African Development Bank.

BY KINGSLEY ASARE