The Dangme Rural Bank (DRB) Limited in the Greater Accra Region has recorded a loss before tax of GH¢2, 147,246 in 2021 as against GH¢ 113, 904 in 2020, representing a dip of 179 per cent.

The Bank’s loan advances also decreased from GH¢12,788,090 in 2020 to GH¢ 12,363,343 in 2021, representing a three per cent dip.

However, investment increased by 18 per cent from GH¢ 22,186,823 in 2020 to GH¢ 26,242,360 in 2021, while total assets also improved from GH¢ 47,237,298 in 2020 to GH¢ 49,804,490, representing five per cent increase.

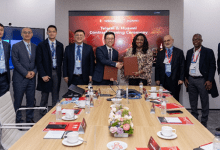

The Chairman of the Board of Directors, Nene Affum Kaafra III, disclosed these at the 37th annual general meeting of the bank on Saturday.

He said the bank’s total operating income improved by 18 per cent from GH¢ 7,122,105 in 2020 to GH¢ 8,374,089 in the year under review.

According to him, the amount represented balances on itrans account and uncleared effects which became outstanding after system upgrades at ARB Apex Bank Limited some years ago.

He stated that in as much as the bank liaised with the ARB Apex Bank to seek for reconciliation of the balances, no resolution was arrived at as the retrieval of data posed a challenge.

Nene Kaafra III said the amount of GH¢ 8,374,089, being the total operating income for 2021, as compared with GH¢ 7,122,105 in 2020 impacted negatively on the bank and significantly registered a net loss of GH¢ 2,147,246 for the year under review, thereby affecting shareholders fund.

He explained to the shareholders that the bank painstakingly arrived at the decision in order to clean the books for a smooth and brighter future of the bank.

Acting Head, Banking Operations at ARB Apex Bank, Mark Odoi Adjei, who represented Alex Kwasi Awuah, the Managing Director of the Apex Bank, stressed the need for the bank to grow the micro-savings schemes also known as ‘susu’ which were popular with small savers in various trades, including farmers, market women, teachers, and itinerant workers whose incomes may not be able to afford bigger savings.

“Let us desist from chasing large depositors who also demand higher interest payments on their deposits”, stressing the need for a careful balance between retail and large deposits with the former which could guarantee sustainable and long term growth in assets,” he said.

FROM KEN AFEDZI, OLD NINGO