The Monetary Policy Committee (MPC) of Bank of Ghana (BoG) has increased the policy rate on the back of rising inflation.

The MPC, after its 103rd meeting yesterday in Accra to review the developments in the economy, raised the policy rate by 100 basis to 14.5 per cent from 13.5 per cent.

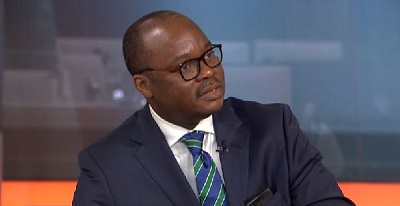

Dr Ernest Addison, the Governor of BoG, who chairs the MPC, said the “Headline inflation has risen consistently from the low of 7.5 percent in May 2021 to 11.0 per cent in October, driven by both food and non-food price increases. In addition, all the Bank’s core measures of inflation have increased, indicating broad-based underlying inflation pressures with the potential of de-anchoring inflation expectations. Currently, headline inflation is above the upper limit of the medium-term target band and the Committee noted significant risks to the inflation outlook.”

“These risks include rising global inflation, high energy prices, uncertainties surrounding food prices and investor behaviour. The Committee noted that these elevated inflationary risks require prompt policy action to re-anchor inflation expectations to safeguard the central bank’s price stability objective,” he said.

Dr Addison said in the domestic economy, the Committee assessed that the recovery in the real sector was progressing at a steady pace.

He said the high-frequency economic indicators reflected increased momentum in the pace of economic activity, close to pre-pandemic levels and consumer and business sentiments had turned around, driven by perceived improvements in economic prospects.

“Credit to the private sector is beginning to expand, albeit at a slow pace. The COVID-19 related macro-prudential measures, still in force, remain supportive of the recovery process, steadily driving up new advances over the period. The recovery in credit is expected to continue on the back of anticipated net ease in credit stance by banks and increased demand,” the Governor, said.

He said the BoG’s updated Composite Index of Economic Activity (CIEA) recorded an annual growth of 11.2 percent in September 2021, compared with 10.8 percent and 4.2 percent in the corresponding periods of 2020 and 2019respectively, adding that the stronger growth in the CIEA was driven by domestic VAT, industrial consumption of electricity, port activity, imports, and air-passenger arrivals. Construction activities, however, slowed down somewhat.

Dr Addison said the results of the latest confidence surveys signaled continued improvement in both business and consumer sentiments, pointing out that businesses met short-term company targets and were optimistic about company and industry prospects as the yuletide approached, despite concerns about high cost of raw materials and exchange rate depreciation, and, similarly, consumer confidence improved on account of positive economic prospects.

On the global economy, Dr Addison said global price pressures on the other hand, had intensified with headline inflation rising above targets in several advanced and emerging market economies.

He said the rise in inflation broadly reflects rising energy prices, resurgence in global demand, and supply chain constraints. Although the rise in inflation was deemed transitory in the first half of 2021, it is becoming embedded, raising policy uncertainties in the outlook.

“Inflationary pressures are becoming embedded in most advanced and emerging market economies with potential implications for the current supportive financing conditions driving the recovery, saying the increased concerns about the strength of the recovery and the stronger US dollar has exerted currency pressures in some emerging market and frontier economies, and consequently, policy rates in some emerging market countries had been hiked to counter rising inflation,” the Governor, said.

However, Dr Addison said the global economy had continued to recover, but, the intensity of supply constraints, including slack in the labour markets and shortages in intermediate goods had moderated the pace of growth.

BY KINGSLEY ASARE