THE Association of Rural Banks (ARB) has said Rural and Community Banks (RCBs) are finding it difficult to expand due to the payment of huge corporate tax.

According to the association, the issue had crippled the operations of most of the RCBs and there was the need for the government, Bank of Ghana and the Securities and Exchange Commission (SEC) to intervene and give them tax exemptions.

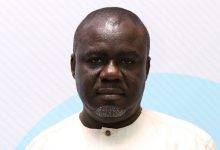

The President for the ARB, Upper East Chapter, Mr Cletus Azaabi, made the call in a speech read for him at the the 22nd annual general meeting of the Builsa Community Bank, held at Sandema in the Builsa North District of the Upper East Region on Saturday.

Mr Azaabi noted that it was only fair for the government to consider their request to mitigate the challenges bedeviling RCBs sub-sector because of its large contributions to the development of the country.

He added that it was “sheer discriminatory if not neglect” for the government to give tax exemptions to some foreign entities operating in the marginalised parts of the country, but chose to neglect the RCBs who contributed a lot to the development of the country.

The RCBs subsector, the president said, could not be underestimated since it had consistently promoted government’s financial inclusion drive in the rural communities; including supporting farmers and people in the agri-business value-chain.

“We have the largest customer base of over 8 million, and without the RCBs subsector, there would be chaos in this country,” he said.

In her report for the year under review, the Chairperson of the Board of Directors of the Builsa Community Bank Ltd, AsokeaAgamuAkanbangbiem, said the year 2021 was a successful operational year for the bank, despite the challenges confronting the sector.

She pointed out that there was a considerable growth in all the key balance sheet indicators, pointing to the resilience and long-term sustainability of the bank.

“The total assets of the bank increased by 8.62 per cent to GH¢ 45.91 million from GH¢ 42.27 million, the previous year, 2021.

“The net profit before tax also recorded a total of GH¢ 1, 105,671 at the end of the year 2021, which was an increase of 14.43 per cent from the amount of GH¢ 966, 239 recorded the previous year. This was achieved through the improvements in revenue items, effective cost reduction strategies and enhanced operational efficiency,” Mrs Akanbangbiem reported.

To maintain and improve upon the performance of the bank, the Chairperson urged existing and prospective shareholders to buy more shares to support the long term investments of the bank.

For his part, Mr MusahAbugah, Finance and Operations Manager of the Builsa Community Bank Ltd, said loan delinquency was a major issue affecting the growth of the bank, and implored all loan defaulters to do well to settle their debts.#

FROM FRANCIS DABRE DABANG, SANDEMA