Parliament has, at long last, approved the controversial Electronic Transfer Levy (E-Levy), 2021 under a certificate of urgency yesterday.

This was after the Minority caucus washed their hands off any associated procedures on the levy and staged a walk out at the middle of sitting leaving their colleagues in the Majority to pass the revenue measure which is estimated to rake GH¢6.9 billion into government coffers.

The Majority which marshalled all its members but the Dome Kwabenya and Ahanta West MPs into the chamber to adapt the report zoomed straight into the consideration stage of the bill right after adopting the Finance Committee’s report which recommended its approval.

The report has been shelved since December 21, 2021 when fight broke out in the chamber after attempts by the First Deputy Speaker, Joseph Osei Owusu, to vote to determine whether or not the consideration should be taken under certificate of urgency.

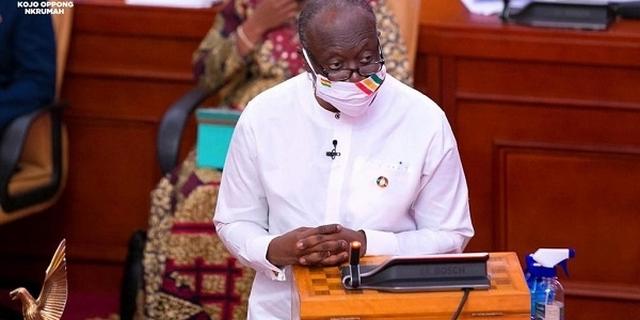

Moving the motion, the Finance Minister, Ken Ofori-Atta, told the House that the proposed levy which has been reviewed from 1.75 per cent to 1.5 per cent on selected electronic transactions, would broaden the country’s tax base and enhance government’s revenue mobilisation mechanism.

Mr Ofori-Atta said with only two million of the estimated 20 million people paying tax in the country, all eligible citizens, with the E-Levy, would contribute a token to the national treasury and urged the lawmakers to support government to have the levy imposed.

Obuasi West MP and Chairman of the Finance Committee, Kwaku Kwarteng, supporting the motion recommended to the House to pass the levy to assist government raise the needed revenue for the development of the country.

A Deputy Minister of Finance and MP for Atiwa East, Abena Osei-Asare, who also made a case for the passage of the levy, said government after consultation has granted exemptions to some categories in the value chain.

“No one gets levied for moving their own cash from one wallet to the other or from one bank account to another provided it is registered in your own name and with Ghana card.

“Again, there are exemptions for transfers between principal agents, master agents and special merchant accounts. So the fear that Momo agents, money issuers, banks and key actors in the value chain would be affected has been taken care of.”

Information Minister and MP for Ofoase Ayirebi, Kojo Oppong Nkrumah, who also advocated for the passage of the levy said, Ghanaians prefer to pay a little more to support government than continue borrowing; a situation which has made the country’s debt level unsustainable.

“Mr Speaker, if you ask the Ghanaian whether we should borrow our way out of our problems or contribute a little bit more out of our problem, the average Ghanaian, I believe would say let us share the responsibility and get out of our problems,” Mr Nkrumah said and called on the House to adopt the Committee’s report and proceed with the consideration.

But the Minority which said they were perpetually opposed to the E-Levy maintained that the revenue measure was regressive and a disincentive to businesses and the digital economy government is championing.

Ranking Member on Finance Committee and MP for Ajumako Enyan Esiam, Dr Cassiel Ato Baah Forson, said in as much as they were not against taxation, they were against the structure and design of the E-Levy.

Describing the E-Levy as distortionary that would have negative impact on the economy, Dr Forson said the most affected would be most affected would be the “poor.”

Minority Leader, Haruna Iddrisu, on his part said “because we do not supoort E-Levy, the Minority group, led by me, would not be associated with any further proceedings on the E-Levy.

“We want to be recorded that when E-Levy was brought to the eighth Parliament, we stood together, opposed it, asked for its rejection and we did no support it,” Haruna Iddrisu said before leading his group out.

BY JULIUS YAO PETETSI