Affected customers of collapsed microfinance, microcredit, savings and loans cannot access, authenticate payment – Leader

Affected customers of collapsed microfinance, microcredit, savings and loans companies have raised concern of shortchange from the receiver as they are unable to access their information to authenticate payment.

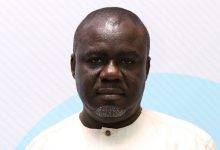

Mr Kofi Sarpong, a leader of the affected group who in an interview yesterday dismissed claims that the account of some customers had been credited as of Tuesday, February 25, said “we want to access our details before validation and payment.”

“None of our members across the country have received any message or been credited any money so far. We have even been asking for our information from the receiver but we are being denied and we fear we may not get our exact money.”

According to Mr Sarpong, members who had prior to the recent announcement received messages for payment had been given less than their actual money “and when they questioned they were told that is what they were given by the companies.”

“The situation is creating a lot of tension and frustration among members who are threatening to besiege the receiver’s office so we are pleading that if they want to pay us our full money, then they must let us verify our information.”

The leader of the affected group asked that customers be migrated onto one account to easily access their funds saying; “the strategy of using text message over the past few months has been problematic. They can put a cap on the amount to withdraw once the account is created but that will be better than the strategy they are using now.”

Following several promises to pay customers of collapsed microfinance institutions and savings and loans companies, government through the Ministry of Finance on Monday, February 24 released GH¢ 5 billion to the receiver, Mr Eric Nipah, to offset outstanding debts.

The amount is said to be a combination of cash and bonds to totally settle depositors.

The Consolidated Bank Ghana Limited (CBG) appointed by the receiver to pay out customers is reportedly said to have credited the accounts of about 1,300 customers with full amounts as of Tuesday.

The figure is said to represent the first batch of customers whose claims have been validated by the receiver.

Head of Corporate Communications at CBG, Dr Mrs Anita Oppong explained that the affected customers were largely institutions and organisations whose funds were locked up in one or more of the 400 specialised deposit-taking institutions that lost their licences in the banking sector clean up last year.

Efforts however, to reach the CBG on customers’ denial of funds accredited to their accounts proved futile as several calls placed to available telephone lines of the receiver went unanswered.

BY ABIGAIL ANNOH