The Ghana Revenue Authority is allaying fears over the projected loss of revenue from tax collection due to the implementation of the African Continental Free Trade Agreement (AfCFTA) in the short term.

According to the World Bank, there will be a decline in port tariffs for member countries, as a result of the trade agreement.

The decline in revenue is expected to be moderate in the early years due to progressive liberalisation, however, in the longer term, between 2025 and 2045, the decline will increase from three to nine per cent.

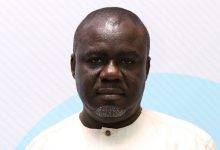

Speaking in an interview with Joy Business after addressing the Tax Research Network Congress, Commissioner General of the Ghana Revenue Authority, Rev. DrAmishaddaiOwusuAmoah, explained that trade between African countries were minimal, hence the impact on revenue loss won’t be significant.

“You will agree with me that the intra-African trade is not huge and therefore the initial losses are not expected to be significant. But we can’t be idle with coming up with strategies so that as we integrate the systems, people may take advantage of the systems like what happened in the European Union with the introduction of VAT,” he said.

“To this end, we are ensuring efficient systems and strategies that will ensure maximisation of trade and boost in revenue for the long term,” he said.

He was confident that the summit would come out with seamless policy recommendations that could help deal with revenue challenges by member states.

This is the first time Ghana is hosting the African Tax Researchers Network Congress.

Revenue and Grants fell short of target in first-half of 2022.

The Ministry of Finance is expected to mobilise ¢100.5 billion in revenue and grants in 2022.

However, total Revenue and Grants amounted to ¢37.808 billion (7.5 per cent of Gross Domestic Product), compared with the target of ¢43.421 billion (8.6% of GDP) and ¢30.461 billion (6.6 percent of GDP) recorded in the corresponding period in 2021.

The outturn for Total Revenue and Grants represents a shortfall of 12.9% compared to the period’s target and year-on-year growth of 24.1 per cent.

The shortfall in revenue, the Finance Ministry said stemmed from the less robust performance recorded in all the revenue handles for the period.

The revenue losses would also be less because Afreximbank and the African Continental Free Trade Area (AfCFTA) Secretariat last year announced that the two institutions were in the final stages of negotiating a 10 billion dollar adjustment fund, aimed at cushioning countries that are likely to suffer short-term tariff revenue losses as a result of the implementation of the AfCFTA,

Mr Wamkele Mene, Secretary-General of the AfCFTA Secretariat, who disclosed this at a press briefing to draw the curtains on the second Intra-African Trade Fair( IATA) 2021 held in Durban, South Africa, last year said, “it is going to be for a country that says my textiles and clothing sector is suffering, the fund will then intervene and provide direct intervention support to the sector either for retraining of workers or for recapitalisation or for procuring machinery for goods or to increase competitiveness that’s what the fund will be for, as I said we are in the last stages of negotiating a joint venture for this AfCFTA adjustment fund. ”

He said “Ultimately, what we should aim for is that tariffs or duties should not be a tool for revenue generation but industrial development tool but the reality is that we are a long way from that and that’s why the AfCFTA exists to make sure we move away from that reliance.”