Insurance companies have been tasked to consider marketing annuities for pensioners instead of allowing them carry their lump sums home.

Mr Kofi Andoh, Deputy Commissioner of the National Insurance Commission (NIC), said although annuities were not part of the country’s insurance products, it would be good for industry players to explore it and make the public appreciate its advantages as the Social Security and National Insurance Trust (SSNIT) ends lump sum payment in January 2020.

Speaking at the Ghana Insurers Association Investiture of President and swearing-in of new board members in Accra, Mr Andoh said contributors of SSNIT would have to turn to fund managers of their second tier contributions for lump sums.

He said annuities are good, hence the need to build the capacity of insurance companies adding that government should also develop investment markets for businesses to thrive.

Mr Andoh said the development of investment market would generate regular cash flow and help scale-up economic growth.

Mr Andoh said “we need people to understand and buy annuities as SSNIT ends the payment of lump sums.” Annuity is a fixed sum of money paid to someone each year typically for the rest of their life. It is also a form of insurance or investment entitling the investor to series of annual sums.

The Deputy Commissioner said as the country embraces the African Continental Trade Agreement, it was necessary to re-strategise, increase capital investment and ensure good corporate governance in order to compete in other countries.

He called on insurance companies to take a second look at issues concerning climate change and agriculture insurance. “We also need electronic marine insurance database. Currently marine businesses are struggling and we need to fix that,” Mr Andoh said.

Nana Dr Appiagyei Dankawoso I, President, Ghana National Chamber of Commerce and Industry, who chaired the ceremony, questioned why banks were taking over from insurance companies.

Nana Dankawoso said the passage of the New Insurance Act was going to provide micro and agriculture insurance which would boost insurance penetration.

He cautioned insurance companies on the need to be wary of electronic crime which has cost banks of GH¢ 110 million in recent times.

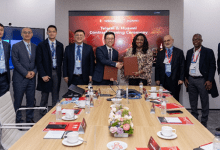

Ms Aretha Abena Abrafi Duku, the President of GIA, was reelected to serve another two year mandate.

The GIA has currently 20 life insurance companies, 29 non- life insurance companies and four reinsurance firms.

Ms Duku, the 10th President of the Association, and the nine member board were sworn into office by Mrs Justice Angelina Mensah Homiah, a High Court Judge. Ms Duku said there is the need to intensify insurance education among the public adding that “we are going nowhere without insurance education.”

The President of GIA said the Association would be introducing an online magazine that would reach out to more readers and educate the young ones.

Ms Duku said the GIA would begin with cartoon sketches for kids to whip up their interest as well as educate them on insurance adding that “we should never undermine children’s ability to interest adults in purchasing insurance policies for their future,” she said.

She said the Association was also going to get its forensic laboratory as well as embrace technology in order to come out with innovative insurance products.

“We want an insurance industry that is respected… an industry that lives up to its global legacy as a pillar of any economy, one leading with innovative technology and best business practices internationally,” Ms Duku said.