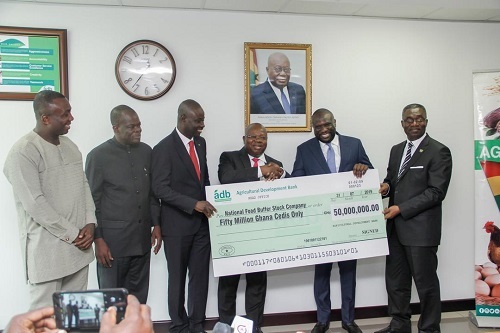

The Agricultural Development Bank (adb) yesterday supported the National Food Buffer Stock Company (NAFCO) with GH ₵ 50million for the purchase of grains from farmers under the government’s flagship programme – Planting for Food and Jobs (PFJs)

The grains to be purchased, including maize, rice and cowpea would be supplied to government assisted Senior High Schools (SHS).

The facility would further support NAFCO to mop up excess produce from farmers to reduce post-harvest losses.

The bank in 2008 provided a facility of GH₵20 million to NAFCO to purchase grains held by farmers who produced them under PFJs.

NAFCO was said to have performed creditably and paid back the loan facility on schedule.

This achievement, the Managing Director of adb, Dr John Kofi Mensah said gave the bank the confidence to increase the amount to GH₵50 million, which he said was only a first trench.

“The amount increased to GH₵50 million was underpinned by the fact that the cultivated area under the PFJs has increased coupled with the third stream of free SHS students who would be going to school in September, with the attendant increase in food requirement,” he added.

He indicated that the bank’s readiness to support NAFCO to purchase grains and other foodstuffs for supply to secondary schools.

Dr Mensah expressed concern about the country’s annual post-harvest loses which ranges between 20 and 50 percent of all vegetables and 20 to 30 percent of grains, adding that; “the bank would continue to support the buffer stock company to provide a reliable marketing outlet for the farmers.”

He said the bank was looking forward to partner NAFCO in setting up appropriate post-harvest and processing technologies to deal with the many perishable such as plantain and tomatoes.

The managing director stated that, adb would continue to support government’s agricultural initiatives and interventions as the bank had committed more than GH₵100 million in the form of letters of credit and working capital loans to input suppliers under the PFJs project.

“As a bank with a developmental focus and mandate to provide financial intervention for the development and modernisation of Ghana’s agricultural sector, we are aware of our strategic role in providing finances to accelerate the growth of the agricultural sector and allied sectors,” he added.

The Chief Executive of NAFCO, Alhaji Hanan Abdul-Wahab, commended the bank for the confidence reposed in his outfit.

He said the introduction of the PFJs has significantly changed the landscape of agriculture in the country, leading to increase in food productivity.

He added that the availability of ready markets have enhanced the successes chalked under the programme.

The core mandate of NAFCO, he explained, was to offer local farmers a ready market for their produce, thereby reducing post-harvest losses and improving productivity in subsequent years.

Some of the grains, Alhaji Abdul-Wahab noted would be used to improve the country’s emergency food reserves after supplying the schools.

BY LAWRENCE VOMOFA-AKPALU