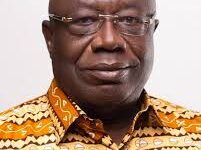

The National Insurance Commissioner (NIC), Mr Justice Yaw Ofori, has called on insurance companies to come out with innovative products to meet the changing needs of customers.

He said there was the need for attractive products to engage clients and deepen insurance penetration and urged life insurance companies to do more in that direction.

Mr Ofori was speaking at the launch of Enterprise Group Funeral Finance Plan Unlimited, a product aimed at not just penetrating the insurance sector but also modifying life insurance.

“There is a need for the industry players to be innovative in their product offerings. Customer needs and demands keep changing daily. There is the need to have attractive products to meet such needs,” Mr Ofori said at the launch.

The Funeral Finance Plan Unlimited provides unlimited coverage in terms of age restriction and offer benefits to policy holders, a 100 per cent premium refund, life swap which allows customers transfer policy benefits to relatives who were not initially included in the policy, and cash back benefits, among several others.

On his part, the CEO of Enterprise Group, Mr Keli Gadzekpo, says the product seeks to create extensive funeral coverage for customers who would have otherwise been excluded from general funeral policies, which have very restrictive terms and conditions.

Mrs Jacqueline Benyi, the Managing Director of Enterprise Life Assurance Company Limited, said the Finance Plan Unlimited was launched in response to customers’ demand.

“Customers are the real reason behind this new product. It sets out as the first and best in the finance funeral insurance.” GNA